The AI Copilot for PE Funds Due-diligence

LP Insight automates data-room review, extracts key terms, analyzes performance, and drafts IC-ready materials. We help Limited Partners spending less time processing information and more time making decisions.

Our Trusted Partners:

Upload your fund data room

Drag & drop your data room (.zip)

-

Fund Dashboard

Turn hundreds of fund documents into a single interactive dashboard. Our AI reads the entire data room and highlights key information by theme, from track record and strategy to team and market, all in one place.

-

Automated Risk Flags

Spot red flags and inconsistencies automatically. LP Insight flags anomalies or out-of-line metrics and even suggests questions to raise with the GP. Never miss a critical issue hidden in the fine print.

-

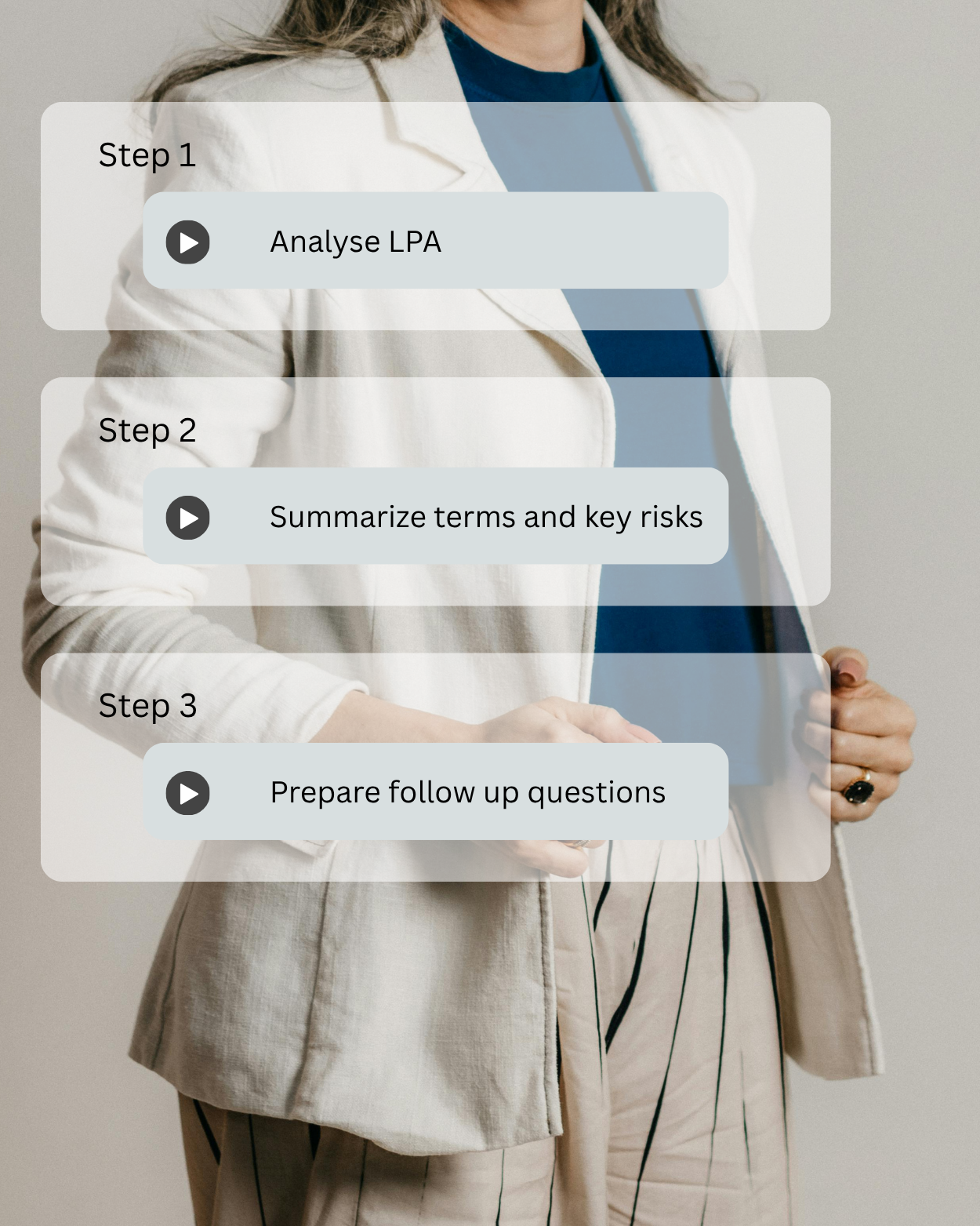

Key Terms Digest

Get a concise summary of all essential legal terms. Our AI reviews the LPA, PPM, subscription agreement and more, extracting fees, hurdles, governance terms, and conditions. Skip the legalese, see every important term at a glance.

-

IC Memo Assistant

Generate your Investment Committee notes in minutes. Ask our AI to draft sections or an entire IC memo following your internal format. It pulls together all findings from your due diligence so you can refine the final document instead of writing from scratch.

Designed exclusively for Limited Partners

Every feature of LP Insight reflects real LP workflows and priorities, honed by our team’s experience in private equity and fintech. The result is a solution that meets you where you are, whether you’re assessing a venture fund or a large buyout fund, performing preliminary screening or deep due diligence. Focus on strategic decisions, while we handle the heavy lifting of data and documents.

As an LP, I’m used to spending days digging through data rooms that all look different and are organised inconsistently. LP Insight doesn’t magically replace judgment, but it cuts through the noise. It flags what matters, structures the rest clearly, and lets me focus my time on forming a view rather than collecting documents.

Emma R.

Director, European Pension Fund

We’ve tried various internal templates to standardise fund reviews, but nothing ever stuck. LP Insight finally gave us a consistent framework across teams. Our IC discussions became faster and more precise because everyone walks in with the same dashboards, the same definitions, and the same interpretation of terms and performance metrics.

Michael T.

Partner, Fund of Funds

I don’t have a large team, so the biggest value for me is how fast LP Insight turns dense materials into a concise risk picture. It highlights odd clauses, missing information, and performance nuances that are easy to overlook. It simply allows me to get to the substance dramatically faster.

Sophie L.

Head of Private Markets, Family Office

We used to rebuild spreadsheets for every new opportunity. With LP Insight, we drop everything in and immediately get clean performance charts, fee summaries, and a clear structure of each document. The time savings are real, and it keeps our process much more consistent across the team.

Jonas B.

Investment Manager, Endowment

As an LP, I’m used to spending days digging through data rooms that all look different and are organised inconsistently. LP Insight doesn’t magically replace judgment, but it cuts through the noise. It flags what matters, structures the rest clearly, and lets me focus my time on forming a view rather than collecting documents.

Emma R.

Director, European Pension Fund

We’ve tried various internal templates to standardise fund reviews, but nothing ever stuck. LP Insight finally gave us a consistent framework across teams. Our IC discussions became faster and more precise because everyone walks in with the same dashboards, the same definitions, and the same interpretation of terms and performance metrics.

Michael T.

Partner, Fund of Funds

I don’t have a large team, so the biggest value for me is how fast LP Insight turns dense materials into a concise risk picture. It highlights odd clauses, missing information, and performance nuances that are easy to overlook. It simply allows me to get to the substance dramatically faster.

Sophie L.

Head of Private Markets, Family Office

We used to rebuild spreadsheets for every new opportunity. With LP Insight, we drop everything in and immediately get clean performance charts, fee summaries, and a clear structure of each document. The time savings are real, and it keeps our process much more consistent across the team.

Jonas B.

Investment Manager, Endowment

What surprised me most is how LP Insight helped unify the way our regional teams work. People in Europe, Asia, and the US were using slightly different approaches. Now they start from the same outputs and workflows, which makes collaboration smoother and improves the quality of our global fund reviews.

Clara D.

Global Head of PE, Asset Manager

For desktop diligence, time is always the constraint. LP Insight doesn’t replace experience, but it accelerates everything around it. What used to take days—organising files, extracting relevant passages, checking terms—now happens in a couple of hours, letting me focus entirely on the substance of my recommendations.

Alex P.

Managing Director, Consultant

In a small investment team, every hour counts. LP Insight helps us operate with the discipline and structure of a much larger organisation. It gives us clean summaries, highlights inconsistencies across documents, and makes it easier to compare opportunities. It’s genuinely become the first step in our due-diligence process.

Nadia K.

CIO, Single Family Office

From a governance perspective, LP Insight is extremely useful. Every key point is traced, the underlying source is referenced, and the IC memo exports are clear and auditable. It’s made our decision-making more transparent and gives me confidence that nothing important has been missed.

Thomas G.

Chair, Investment Committee

What surprised me most is how LP Insight helped unify the way our regional teams work. People in Europe, Asia, and the US were using slightly different approaches. Now they start from the same outputs and workflows, which makes collaboration smoother and improves the quality of our global fund reviews.

Clara D.

Global Head of PE, Asset Manager

For desktop diligence, time is always the constraint. LP Insight doesn’t replace experience, but it accelerates everything around it. What used to take days—organising files, extracting relevant passages, checking terms—now happens in a couple of hours, letting me focus entirely on the substance of my recommendations.

Alex P.

Managing Director, Consultant

In a small investment team, every hour counts. LP Insight helps us operate with the discipline and structure of a much larger organisation. It gives us clean summaries, highlights inconsistencies across documents, and makes it easier to compare opportunities. It’s genuinely become the first step in our due-diligence process.

Nadia K.

CIO, Single Family Office

From a governance perspective, LP Insight is extremely useful. Every key point is traced, the underlying source is referenced, and the IC memo exports are clear and auditable. It’s made our decision-making more transparent and gives me confidence that nothing important has been missed.

Thomas G.

Chair, Investment Committee

-

Buyout

Get a complete view of portfolio performance, leverage profiles, and value creation levers.

-

Secondaries

Analyse historical NAV trends, vintage exposure, and underlying fund quality with precision.

-

Venture Capital

Understand diversification, follow-on capacity, and track record consistency — all from the data room.

-

Private Credit

Gain transparency into portfolio composition, collateral quality, and downside protection.

Entreprise-Grade Security

Your data is in safe hands. We know how sensitive fund information can be, and LP Insight enforces rigorous security standards to keep your data secure, private, and compliant.

ISO 27001

LP Insight follows the ISO 27001 framework for information security management, ensuring we have strict processes for data handling and risk management.

SOC Type 2

We meet SOC 2 requirements to ensure secure and compliant management of data across all our systems.

GDPR

Operating under GDPR guidelines means we meet one of the world’s most stringent data privacy regimes

Ready to transform your due-diligence ?

Discover how LP Insight can put hours back in your week and help you invest with greater confidence.